Aluminium production in Germany continued to decline in the second quarter. The German Aluminium Association is very concerned about the energy crisis, in particular the recently adopted gas levy.

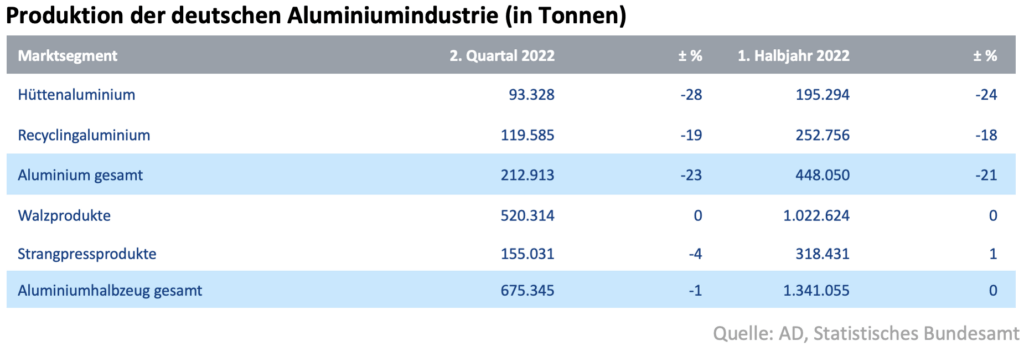

Aluminium production in Germany fell in the second quarter of 2022, in some cases significantly. With a decline of 23%, the production of raw aluminium shrank particularly sharply. After the first half of 2022, this figure is down by a good fifth (-21%) to 448,000 tonnes. The price of electricity has recently reached a new record level and poses existential challenges, especially for the electricity-intensive aluminium smelters in Germany.

At 675,000 tonnes, the production volume in the semi-finished products segment in the second quarter was just below the level of the same period in the previous year (-1 per cent). Among these, however, manufacturers of aluminium extrusions recorded a decline of 4%, while the production of rolled products remained stable (+-0%). In the year to date up to June, semi-finished product manufacturers achieved a total volume of 1.34 million tonnes (+-0%).

Hinrich Mählmann, President of Aluminium Germany (AD), commented: "If we don't find a solution to the energy crisis quickly, there will soon be no more aluminium smelters in Germany. They are under acute threat. This industrial base must be preserved at all costs. We know from painful experience the consequences of excessive dependence on important raw and basic materials. The Green Deal remains the key challenge and aluminium is a key to decarbonising the entire industrial supply chain. Creeping deindustrialisation means relocation to regions with significantly lower social and environmental standards - with corresponding consequences for the climate. That's why we shouldn't saw at the branch we're sitting on."

Gas levy creates high additional burden

According to the association, the recently adopted gas levy will result in additional costs of almost 300 million euros for the non-ferrous metals industry. The aluminium industry accounts for the majority of this, around two thirds. This would result in additional costs, especially for more gas-intensive businesses such as recycling companieswhich quickly went into the five-figure euro range per employee.

Mählmann continued: "The gas levy is basically a necessary instrument to secure Germany's supply. However, its specific design should be reconsidered. Politicians now have a responsibility not to knock over the second domino with the gas-intensive industry after having supported the first. Extending the levy over time, as demanded by the entire industry, would be a first step. Berlin should also consider using the excess tax revenue that the state generates from high energy prices to provide relief. The levy puts companies that are already heavily burdened at an additional disadvantage in international competition."

Source: Aluminium Deutschland e.V.

Further news from the market

Packaging machinery sector sees moderate growth

O-I Glass sees structural growth in non-alcoholic beverages

Anuga FoodTec presents key theme 2027

Printing inks for packaging hold their own in a weak market environment