According to the latest data from NielsenIQ, one in ten beers in Germany is now sold in cans. This form of packaging continues to grow - with clear implications for brands, retailers and the packaging industry.

Beer sales in Germany are changing - and with them the preferred forms of packaging. According to the latest figures from market research company NielsenIQ, cans now account for ten per cent of all beer sales. The figure is even higher for mixed beer drinks: Here, the proportion of cans is as high as 17 per cent. According to Lebensmittel Praxis, this corresponds to a total of 344 million cans sold in 2023.

There are many reasons for the growing demand for tins. Consumers particularly appreciate the convenience, low weight and suitability for travelling. In addition to consumer behaviour, logistics and recyclability also play a role for the packaging industry: beverage cans are made of aluminium or tinplate and are fully recyclable. Modern production processes are also constantly achieving material savings.

New target groups, new expectations

Younger consumers in particular are reaching for cans more often - and not just in the festival or to-go context. Packaging is also gaining presence in traditional sales channels such as food retail. Industry experts are observing increasing differentiation: in addition to traditional beer brands, craft beer producers, international brands and suppliers of non-alcoholic variants are also focussing on cans to create visibility on the shelf and reach new target groups.

The challenge of sustainability

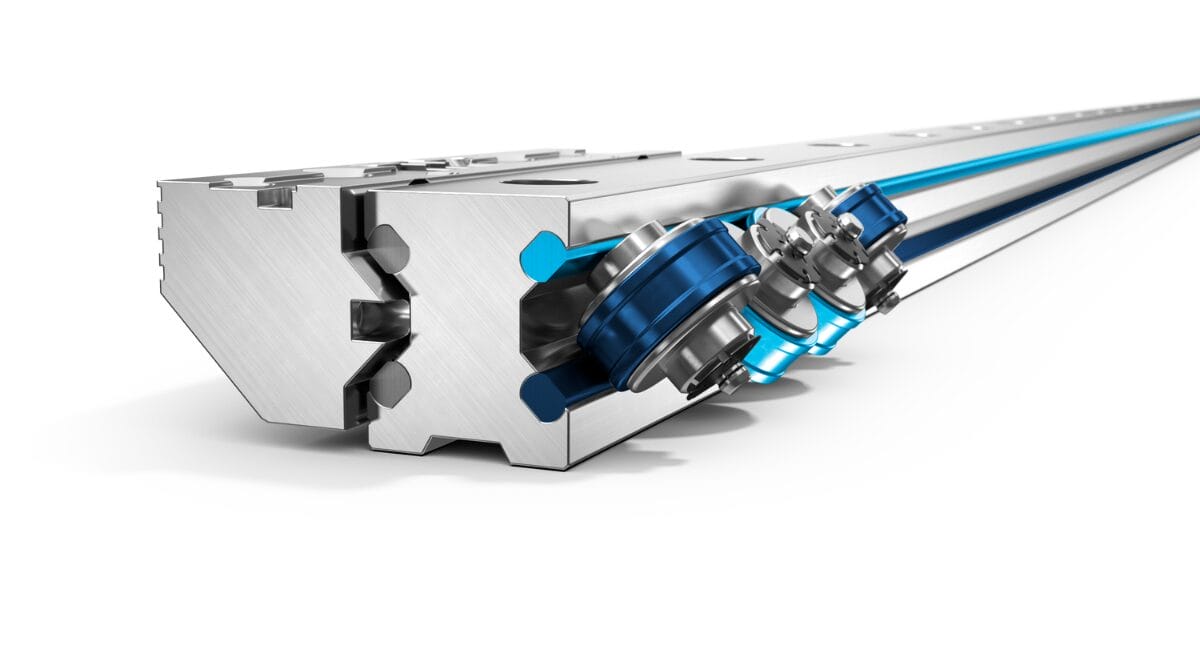

Despite positive recycling balances, the beverage can is repeatedly criticised, especially in comparison to reusable bottles. Manufacturers and retailers need to keep an eye on the conflicting goals of convenience, carbon footprint and legal requirements. Current developments in the area of material efficiency, recycling via deposit systems and innovations in can closures are aspects with which the industry is responding to environmental debates.