According to a recent McKinsey study on global consumer preferences in 2025, price and quality will remain the most important purchasing criteria - even for packaging. Sustainability aspects such as recyclability are still relevant, but are often given lower priority. Country and age differences require targeted strategies from packaging manufacturers and brands.

Despite global issues such as inflation, the consequences of the pandemic and geopolitical uncertainties, there are clear differences between countries when it comes to the perception and evaluation of packaging materials. This is the result of an international McKinsey survey conducted at the beginning of 2025 with over 11,000 consumers from eleven countries. While price and product quality are most frequently cited as decisive factors worldwide, the environmental aspect usually ranks significantly lower in the overall assessment. In some European countries such as France and Italy, however, environmental impact is given greater consideration.

Sustainability in packaging: Importance remains, priority decreases

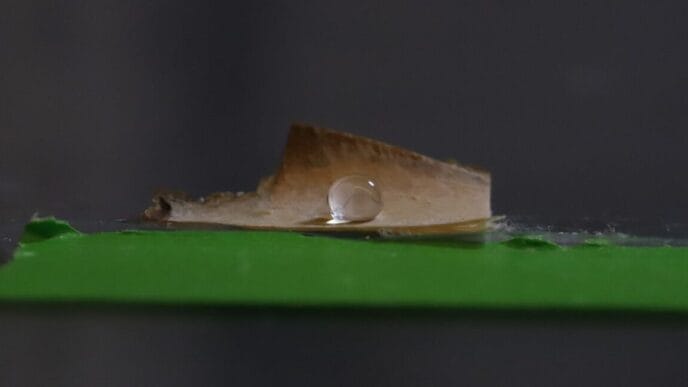

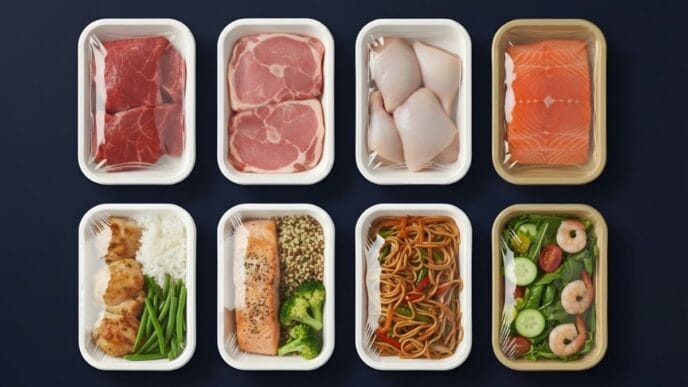

When it comes to packaging, consumers continue to prioritise food safety and shelf life - a trend that has been observed since the COVID-19 pandemic. Although over 50 per cent of respondents consider environmental aspects to be important, they lose relative importance in direct comparison with other factors such as handling or information content. The relevance of environmental impact as a criterion has therefore not changed significantly compared to previous surveys, but is rated less frequently as a decisive factor.

Recyclability as a global benchmark - but differences in perception

Recyclability is the most important feature of sustainable packaging worldwide. Other aspects of the circular economy such as reusability or the use of recycled materials also score well. Bio-based materials or carbon footprint, on the other hand, are less often perceived as crucial. It is striking: In countries with established take-back systems such as Germany, Sweden or Japan, consumers rate PET bottles much more favourably than in countries with lower collection rates such as the USA.

Willingness to pay varies greatly - Generation Z as a lever

The willingness to pay more for sustainable packaging varies around the world. While it is 85 per cent in India, it is only 40 per cent in Japan. Within countries, there are clear differences depending on income and age. Younger consumer groups in particular, such as millennials or Generation Z, as well as people with higher incomes, are more open to additional costs - a factor that brands can utilise in a targeted manner.

Who should act? Consumers call for industry initiative

Regardless of the country of origin, most consumers do not see the responsibility for sustainable packaging as lying with themselves, but with packaging manufacturers and brands. Regulatory authorities and retailers play a subordinate role in the view of the respondents. This expectation illustrates the pressure on companies along the packaging value chain to act.

Three key questions for packaging suppliers

Against the background of these differentiated results, McKinsey recommends data-based strategy development based on three key questions:

- How can sustainable solutions be brought to market faster and targeted at relevant target groups?

- How can the competitiveness of sustainable innovations be increased over the entire life cycle - including production and utilisation costs?

- And how can suitable partners be found for implementation along the value chain?

The study shows: Even if sustainability is not the top priority, it remains a key criterion in the global packaging market. If you want to win over consumers in the future, you have to think differently and act strategically.

Source: McKinsey & Company