The corrugated board industry is proving resilient despite the ongoing economic crisis. While sales increased slightly in 2024, the industry once again suffered significant losses in turnover.

The corrugated board industry can look back on a challenging year in 2024, in which it nevertheless proved to be robust. According to the German Association of the Corrugated Board Industry (VDW), sales increased by 1.1 % to 7.414 billion square metres compared to the previous year.

In contrast, the sector recorded a drop in turnover of 8.2 % - caused by a weak revenue situation and the effects of the ongoing recession.

„As developments in the corrugated board industry are generally closely linked to the overall economic situation and consumer sentiment, this result unfortunately comes as no surprise. In 2024, the German economy experienced a second consecutive year of recession for the first time in over 20 years. Key customers of corrugated board packaging in industrial production were significantly affected by this.“

VDW Chairman Dr Steffen P. Würth

Cost boost for raw materials and logistics

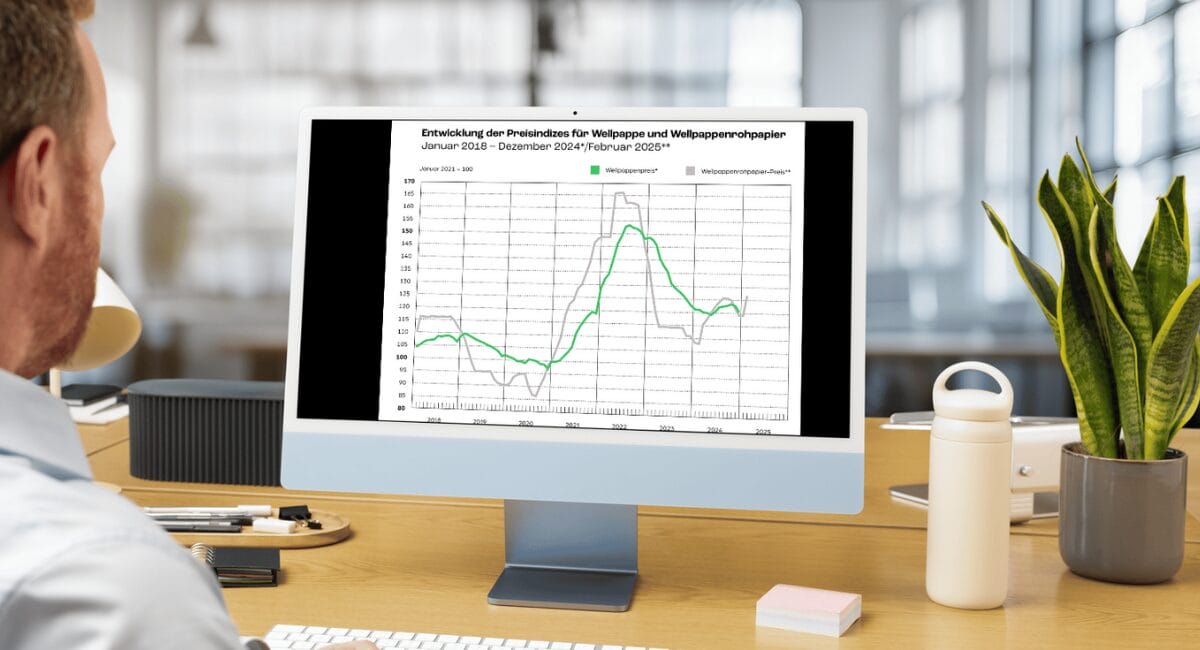

The price trend for corrugated base paper in particular put companies under pressure. The cost of waste paper-based base paper rose by EUR 140 per tonne between March and August 2024; at the end of the year, the price was still EUR 60 higher than at the beginning of the year.

According to the figures, the price increase for fresh fibre-based paper in December was as much as 100 euros per tonne. This was compounded by rising freight costs (+4.7 %) and labour costs (+2.9 %) per employee.

The companies were only able to pass on this cost pressure to their customers to a limited extent, it is said.

Bureaucracy and regulatory burdens are an additional burden

In addition to economic challenges, the industry is complaining about the increasing burden of bureaucratic requirements and documentation obligations. Although initial relief has been promised at EU level through the so-called omnibus package, the actual implementation remains to be seen.

The VDW is positive about the EU packaging regulation (PPWR) adopted in 2024. The fact that the planned rigid reusable quotas for transport packaging were not introduced is an important success for the industry.

„The circular product corrugated cardboard can therefore continue to make a valuable contribution to more environmentally friendly supply chains. And because corrugated board can be adapted particularly flexibly to a wide variety of goods, it is also ideally suited to the reduction in empty space specified by the PPWR,“ emphasises Würth.

Outlook: Focus on sustainability and the circular economy

With a recycling rate of 95.3 %, corrugated board remains a flagship material in the circular economy. Corrugated board also maintains its dominant position in e-commerce with a market share of 90 %.

The industry expects a cautious stabilisation for the current year 2025, but continues to face major challenges in the area of cost efficiency and regulatory developments.

Source: Association of the Corrugated Board Industry