As in every year, the licensing of all sales packaging put into circulation is currently on the agenda. We wanted to know how the players in the market assess the developments in the area of packaging licensing, what impact the aspect of inflation-related price changes has, and what financial leeway remains at all. The developments of the last years and months show: There are differences, so companies should check and compare prices and service offers for their viability.

The situation is tense: increased prices, high inflation rates and, as a result, a pronounced price sensitivity among consumers. This puts pressure on the markets. Therefore, in many sectors and product areas, it is now a matter of taking a closer look at the cost structure and each individual price segment. We have done this and taken a closer look at the cost factor of packaging licensingFor this purpose, we also launched a survey among the dual systems - and almost all of them explained their positions.1)

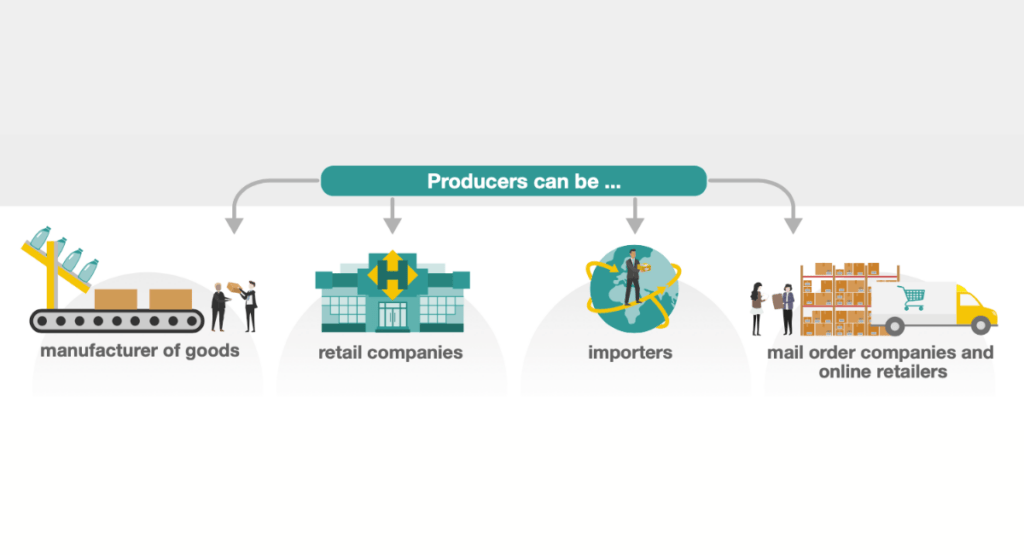

Who needs a licence?

According to the Packaging Act (VerpackG), all companies that commercially market goods in Germany are obliged to register in the LUCID packaging register, regardless of the type and quantity of packaging. In addition to producers, this can also include trading companies, importers of packaged goods or mail-order and online traders if all the requirements apply.

Licensing agreements must be concluded for the expected packaging volumes for their disposal. According to the current state of knowledge, it is estimated that of the 300 relevant top companies, about ten per cent will conclude or have concluded contracts for two years. However, the vast majority of the obligated (six-digit number of) companies circulate such small quantities of packaging that it does not seem to have been worthwhile for these companies to deal with this legally complex issue anew every year. This also applies to customers with micro-circulation contracts, who often conclude their contract online.

General cost development

A decreasing amount of packaging is observed on the market due to weak or negative economic growth and the lower consumption of packaging in the household sector. The fact that purchasing power is declining sharply and that many households are operating at the limits of their budgets plays a role here. The required changes in packaging design also play a certain role.

The effects of the energy price development can hardly be calculated given the energy situation. Equally considerable are the high transport costs that arise during collection and on the recycling routes. Wage and labour costs are also growing significantly, and last but not least, the costs for documentation (§ 21), for volume flow certificates, administration and service are increasing. In addition, very high investments must currently be made in modern and industrially operated sorting facilities for fire protection and sorting technology, which are also included in the calculation of sorting prices.

„An important part of the cost calculation is the globalised raw material markets, as the revenues for recyclables have a price-reducing effect. However, these markets are very volatile and after comparatively high prices at the beginning of 2022, we are currently seeing weak demand for recycling raw materials and thus a very low price level. This has a price-increasing effect on the calculation of licence prices. This is driven, among other things, by the high availability of internationally offered and very cheap primary raw materials,“ explains Markus Müller-Drexel, Managing Director of Interseroh+. Even the indices for recovered paper, a raw material that is actually in high demand, are far below expectations.

Forecast price development

The competition between the dual systems has been a constant source of change. According to a calculation by the Federal Cartel Office, operational disposal costs fell by as much as 54 per cent between 2003 and 2011; Statistically reliable figures on further development are apparently not available. After some ups and downs, there has also been a slight price decline again in recent years. The tenor of some market players is that despite the momentum, many customers are still stuck in old contracts. „An estimated 15 to 20 per cent of distributors are paying too much money for packaging licensing. And these are mainly the companies that do not renegotiate annually or obtain comparative offers, but have not re-tendered their licensing contracts for many years,“ was heard from a dual system. „These companies have not benefited from the positive price developments.“

Some voices from the industry describe the prices for 2023 in particular as no longer covering costs. Here, the existing competition seems to have put the brakes on a price adjustment. However, the underlying price calculations are not always comprehensible within the industry. „From our point of view, ‚the licence price‘ has been under increasing pressure in recent years: a sign of functioning competition. We would also describe the harshness of competition as increasing,“ said other voices from the ranks of the dual systems. This year, several have already increased their prices during the year due to the current situation. The sum of the factors will in all likelihood cause providers to adjust their prices for 2024.

Minimum standard and recycling quotas

The Packaging Act aims to promote high-quality recycling to conserve resources and reduce the impact of packaging waste on the environment. This can only succeed if companies design their packaging to be recyclable and if it is actually recycled in practice. This means that not only packaging manufacturers are obliged to improve recyclability, but also plant technologies, process technologies and their capacities must be adapted to the respective requirements. „To further promote high-quality recycling, it makes sense to further contour the classifications to the factual sorting and recycling capacities. This is the only way to create interest in building recycling capacities. These are declining for individual packaging materials, and it is important to counteract this,“ is the position of the ZSVR.

Compared to the Packaging Ordinance, the Packaging Act presupposes significantly higher recycling quotas, which were even raised again in a second step in 2022. „The higher recycling quotas require deeper sorting, which has also had an impact on the participation fee in the form of higher prices in recent years,“ emphasises Diana Uschkoreit, Managing Director of BellandVision.

Section 21 of the Packaging Act provides for a regulation on the ecological design of participation fees. This is not considered to be sufficiently effective and should be further developed if possible. There are therefore considerations as to whether, for example, a fund should be set up into which producers of packaging that is only marginally recyclable have to pay.

Collection and sorting

The Packaging Act grants public waste management authorities far-reaching rights of co-determination for the collection of used packaging, for example in which containers (sack or bin) and at what frequency used packaging is to be collected. These co-determination rights not only influence the collection quality, but also the costs. Since 2019, the yellow sack has been replaced by the yellow bin in many collection areas. This changeover had a direct impact on costs and thus also on participation fees, not only in terms of acquisition, but also in terms of ongoing operation. The collection of the Yellow Sacks can be done much faster than the emptying of each individual Yellow Bin.

The costs for collecting and sorting the packaging are identical regardless of its recyclability. In order to achieve an effect here in the direction of more sustainable packaging, there is a proposal from the Dual Systems for a fund solution that has already been presented to the relevant bodies and could be included in an amendment to the Packaging Act. This can contribute to the targeted promotion of innovative technologies and the use of more recyclable packaging.

Participation quantity on the move

A recent study by GVM Gesellschaft für Verpackungsmarktforschung and ifeu-Institut für Energie- und Umweltforschung Heidelberg gGmbH analyses and forecasts that packaging consumption has already reached its peak in 2021 and will continue to decline steadily in the coming years. „According to our forecast, in 2024 the participation volume will decrease significantly overall: In this context, GVM forecasts a decline in packaging consumption for 2024 of between four and five per cent for light packaging (LVP), around two per cent for glass and between one and two per cent for PPK, according to Kurt Schüler, Managing Partner of GVM Gesellschaft für Verpackungsmarktforschung, Mainz.

Several representatives of the dual systems also see a significant decline in absolute packaging volumes. Since the entire collection infrastructure must nevertheless be maintained, these volume effects lead to a relative increase in individual licence prices.

The decisive factor will be on which packaging quantities the collection costs will be distributed in future. Those who rely on higher market volumes can offer their licensing customers lower prices but may end up . Those who assume lower market volumes may calculate more realistic prices, but will not convince their customers.

Attention: Eco-Fee modulation

In order to avoid contradictory signals for packaging design through diverging national regulations, the European circular economy package provides for a differentiation of licence fees. The recyclability of packaging is seen as the decisive criterion for eco-fee modulation. EU-wide uniform standards are indispensable to avoid obstacles in the EU internal market. EPR fees or licence fees should be designed in such a way that they create financial incentives for a recycling-friendly design of packaging and enable a cost allocation according to the originator. This is not yet acute (in Germany), but this aspect should be included in the considerations. At some point, it will cost real money if packaging cannot be recycled well. Or it will no longer be allowed on the market - at least that is provided for in the European Packaging & Packaging Waste Regulation (PPWR).

Conclusion

The market is in motion, today more than ever. This applies to the costs of disposal as well as to the price development for the participation of packaging in the dual systems, which are characterised by strong competition - this is the unanimous opinion of the respondents. The dynamics of the influencing factors will already show which forecasts prove to be viable in the coming year. From today's perspective, the sum of the factors will mean that providers will in all likelihood have to adjust their prices for 2024. Those who do not hear from their dual partner now should wake up. The recommendation remains: Check price and service offers for their viability and compare them.

1) We were often asked to use the data only as background information. From this point of view, different positions have been included in our considerations (the sources for all statements are known to the editors).

More packaging news

Asynchronous servo solutions for the packaging industry

Label Durability

More design for recycling for cosmetics packaging

Innovation Barometer 2024