The packaging market is changing: sustainability, changing customer requirements, digitalisation, the commoditisation or increasing substitutability of products and a competitive environment are some of the determining factors in the industry. So how should manufacturers position themselves for the future?

The future of the packaging industry is analysed in detail in a study by management consultants Horváth: Current trends were identified on the basis of extensive project experience and a large number of interviews with the top management of European packaging manufacturers. The results were used to derive theories and directions for the future development of the industry - with Sustainability as a key driver of change in the industry. Recommendations for packaging companies round off the study and show how market players can utilise the developments for their own benefit.

The packaging market is growing steadily, driven in part by the boom in e-commerce for consumer packaging in Europe at four to five per cent per year. A fragmented corporate landscape, Strong competition in some segments and therefore Margin and innovation pressure and the Opportunities for rapid market entry and rapid growth through acquisitions will, as this study shows, further consolidate the industry and allow the major players to continue to grow.

Sustainability as a competitive factor

Sustainability remains the trend-setting trend in the industry, the importance of which will continue to grow and gradually become a commodity. This means Companies that do not have a suitable answer to the issue of sustainability will sooner or later no longer be viable on the market. The Horváth study identifies numerous factors for the increased importance of sustainability and identifies material expertise as an important, if not the decisive competitive factor.

As the study shows, manufacturers focus on the entire life cycle of the packaging - from development and production to use and (re-)utilisation. An overarching core idea is the circular economy with the aim of reusing recycled materials for as long as possible, as shown below:

A key aspect of the circular economy for the packaging industry is the resource-conserving use of packaging materials throughout their entire life cycle. In particular, biodegradable packaging and the substitution of non-renewable by renewable raw materials are increasingly coming into focus. The substitution of plastic with paper plays a central role: developments in paper and fibre-based packaging with good barrier properties can replace the use of mixed packaging with plastic components that is difficult to recycle. Within plastic packaging, the aim is to replace mixed packaging with recyclable mono-material packaging. It is important that the original properties of the packaging are not altered to the detriment of the protective and durability function by changing the use of resources, which requires significant efforts in product development.

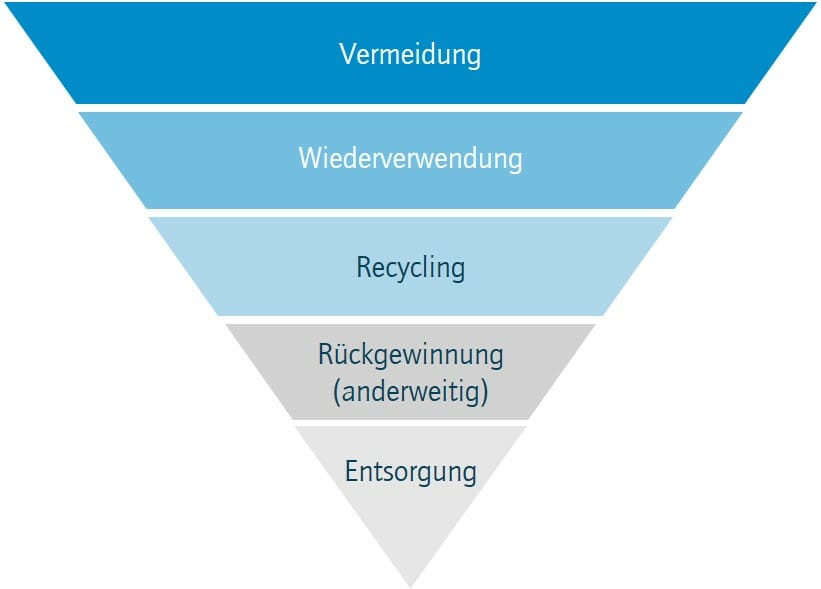

Another important aspect, especially from the consumer's point of view, which can differentiate manufacturers is packaging and waste avoidance. If you look at the five-stage hierarchy of waste management, it becomes clear: The higher up a level, the greater the potential for waste avoidance:

Unsurprisingly Avoiding packaging is the biggest lever, This is also reflected in the significant increase in material efficiency across all types of packaging in recent years. The reuse and recycling of packaging material has also become a regulatory focus - in 2018, it was decided at European level as part of the EU waste package to achieve recycling targets of up to 75 per cent by 2025 for the main materials contained in packaging waste, such as paper, cardboard, metals, glass and plastics. In order to achieve these goals, it is necessary to keep raw materials in circulation as efficiently and for as long as possible. As our study shows, the recycling streams for plastic will become a challenge for the industry.

However, according to the results of the study, the greatest pressure towards sustainability comes from customers in the packaging industry and consumers. Another recent study by Horváth from the consumer goods sector shows, that around three quarters of consumers pay attention to the sustainability aspects of products when buying them and there is also a greater willingness to buy. The packaging must also fit into the sustainable product concept and be demonstrably labelled as such.

In terms of packaging as a product, the market offers opportunities for differentiation not only in terms of sustainability, but also convenience. One digital option for the latter is to expand the classic functions of packaging with additional „intelligent“ features in the sense of „smart packaging“ (e.g. traceability, specific interaction/reaction with the packaged product or sensor technology).

Derived recommendations for action

Based on the identified market trends and drivers of packaging change, we are developing Horváth In its study, the German Federal Ministry of Economics and Technology makes several recommendations for action for companies in the packaging industry in order to secure a relevant position in the market in the future. There are a number of levers that can be addressed in the packaging industry to optimise general cost efficiency: in addition to technical and commercial levers in purchasing and the supply chain, production optimisation from the production footprint to the shop floor, market-oriented pricing and professionalisation of the sales organisation, the Targeted integration of acquisitions to leverage synergies and build up digitalisation expertise The use of automation and cross-divisional efficiency enhancement offers great potential for optimisation. However, this increase in efficiency will no longer be a market advantage in the future, but a prerequisite for remaining competitive in the market at all.

Real differentiation from the competition is only possible through Targeted management of the development and innovation process and portfolio as well as anchoring the topic of sustainability in the company's DNA are successful. Innovations are not just limited to products, but should also be considered more broadly in terms of expanding the company's own strategic strengths through to entire business models or - in the case of sustainability - also in terms of corporate social responsibility (CSR) and all Sustainable Development Goals (SDGs). For example, a company could offer its „sustainability expertise“ in the areas of materials, packaging and packaging development as a consulting service for customers. Processes within the company can also be innovatively sustainable, for example at the interfaces with customers. The potential is manifold.

Guest authorsChristoph Kopp, Head of Studies & Head of Industrial Goods & High-Tech Austria at Horváth and Thomas Hirnschall, Senior Project Manager Industrial Goods & High-Tech at Horváth

Link to the study: „The European packaging industry - trends, prospects and success factors in a competitive market environment“

Further news from the field of sustainability

Italy shows organic expertise

Sustainable action plan for beverage packaging

Sustainable packaging in the spotlight at BIOFACH

Nextpack replaces polystyrene with honeycomb cardboard