Every second company rates the current economic situation as poor and expects no improvement in the coming months. This was determined by the IK Industrievereinigung Kunststoffverpackungen e.V. in a survey of its more than 300 member companies.

After a promising start to the year for many plastic packaging manufacturers, a persistently Weak demand, high energy costs and the shortage of skilled labour The mood in the industry is currently characterised by.

„The main reason for the current crisis is the weakness in demand that has persisted for months: more than every second member company currently rates demand as poor or very poor. This is due to the ongoing destocking by customers and the fall in raw material prices since March. Unfortunately, a rapid improvement is not in sight.“

Dr Martin Engelmann, Managing Director of the IK Industrievereinigung Kunststoffverpackungen e.V.

Four out of five companies have already reduced their production and introduced short-time working ordered. Almost one in five companies has significantly reduced its production.

High energy costs burden competitiveness

In addition, the member companies of the IK are struggling in particular with the high energy costs in Germany, which put German companies at a disadvantage in global competition. Against this background It is incomprehensible that the Federal Government is considering making the price of industrial electricity even more expensive by abolishing the peak equalisation scheme, says Dr Martin Engelmann. „When will politicians finally realise that you can't finance a welfare state with haircuts and tattoos alone?“ asks Engelmann and calls for an industrial electricity price like in France, for example.

The IK survey also shows that plastic packaging manufacturers generally have not reduced the use of recyclates proportionately, although the prices for new plastics have continued to fall. „Plastic recyclers reported a massive drop in sales at the beginning of June. We can now see that at least the use of recyclates in plastic packaging is largely stable,“ explains Engelmann.

Companies consider relocating production abroad

The difficult framework conditions for industrial production in Germany are also affecting the plastics packaging industry: „After all eleven per cent of the companies surveyed are specifically thinking about relocating abroad, five per cent are already in the process of relocating parts of their production or the entire company. Deindustrialisation is taking place before our eyes and it is happening faster than many would have thought“, warns Engelmann and calls on politicians to stop this trend. One reason for hope is that almost every second plastic packaging manufacturer is planning investments in Germany.

While 44 per cent of the companies surveyed at the beginning of 2023 still expected sales prices to rise, a majority (54 per cent) now expect them to do so, that prices will fall in the second quarter of 2023. 33.3 per cent expect sales prices to remain the same. 12.4 per cent of respondents believe that prices will rise.

Stable availability of raw materials

IK member companies rate the availability of raw materials for standard plastics as stable. 64.5 per cent believe that the trend will remain the same, The availability of the market is expected to increase, 8.5 per cent expect it to deteriorate and a quarter (26.8 per cent) even expect it to improve. This development confirms the general economic situation in Germany. The In its economic forecast, the ifo Institute The company noted that the industrial economy is recovering due to easing supply bottlenecks for primary products and sharp falls in energy prices.

Speciality plastics such as EVOH (ethylene vinyl alcohol plastic) or PA (polyamide), which is required for the production of shelf-life extending packaging, remain scarce and therefore expensive. „Plastic films with an effective barrier, such as EVOH, are indispensable for protecting sensitive foods in particular. Due to the current shortage of raw materials, packaging manufacturers are increasingly using oxygen barriers made of polyvinyl alcohol (PVOH)“, says Dr Engelmann.

Even though the availability of raw materials has become more stable overall, companies must continue to handle materials prudently in the future. An important factor here is whether the purchasing organisation has extensive experience in procurement, risk and supplier management. It is advisable to work closely with suppliers, for example through strategic co-operations or partnerships. This is because close dialogue makes it possible to pool expertise and work together on solutions, e.g. through minimum purchase quantities or delivery schedules. The price increases in the plastics industry in particular make it necessary to review the instruments used and to regularly re-evaluate and adjust index-based price clauses. In addition to the increased material costs, transport costs have also risen significantly, companies should also optimise their logistics structures, for example, by reducing waiting times through GPS tracking of the fleet and optimising routes.

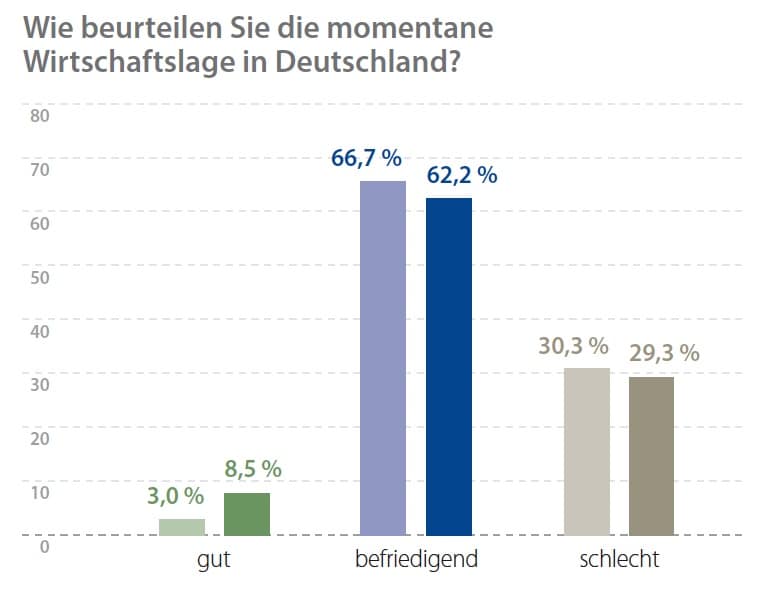

The survey of IK member companies reflects the general economic trend in Germany. Experts from leading research institutes assume that the German economy is currently recovering. Even if the current mood is rather depressed, Experts are forecasting weak growth for both 2023 and 2024 (2024: 1.9 per cent).

Source: IK

IK - More news

What is the mood in the industry?

Packaging industry looks ahead to possible UN plastics agreement

Cautiously optimistic: slight recovery for plastic packaging

How deposit systems work in other EU countries