The packaging industry is suffering from weak demand, high costs and a growing shortage of skilled labour. The IPV is calling for stable framework conditions and a political change of course.

This year's industry survey by the Industrial Association for Paper and Film Packaging (IPV) paints a clearly gloomy picture of economic development in the packaging industry. 80 per cent of the companies surveyed report declining sales for 2024 - compared to 67 per cent in 2023. In addition to the weak overall economic development, business development is being impacted in particular by increased raw material prices, high energy costs and a noticeably hesitant order situation. According to feedback from many companies, customers are continuing to adopt a wait-and-see approach.

Scepticism prevails: No short-term improvement expected

The mood remains correspondingly subdued. No company expects the situation to improve in the short term. On the contrary: 56 per cent of the members surveyed even expect the economic situation to deteriorate further over the course of the year. IPV Managing Director Karsten Hunger describes the situation as tense and emphasises the growing challenges for manufacturing companies to be able to plan economically.

„The current survey of the industry makes it clear how difficult it is for manufacturing companies to stay on course economically in the long term“

IPV Managing Director Karsten Hunger

Investments subject to reservation - focus on energy efficiency

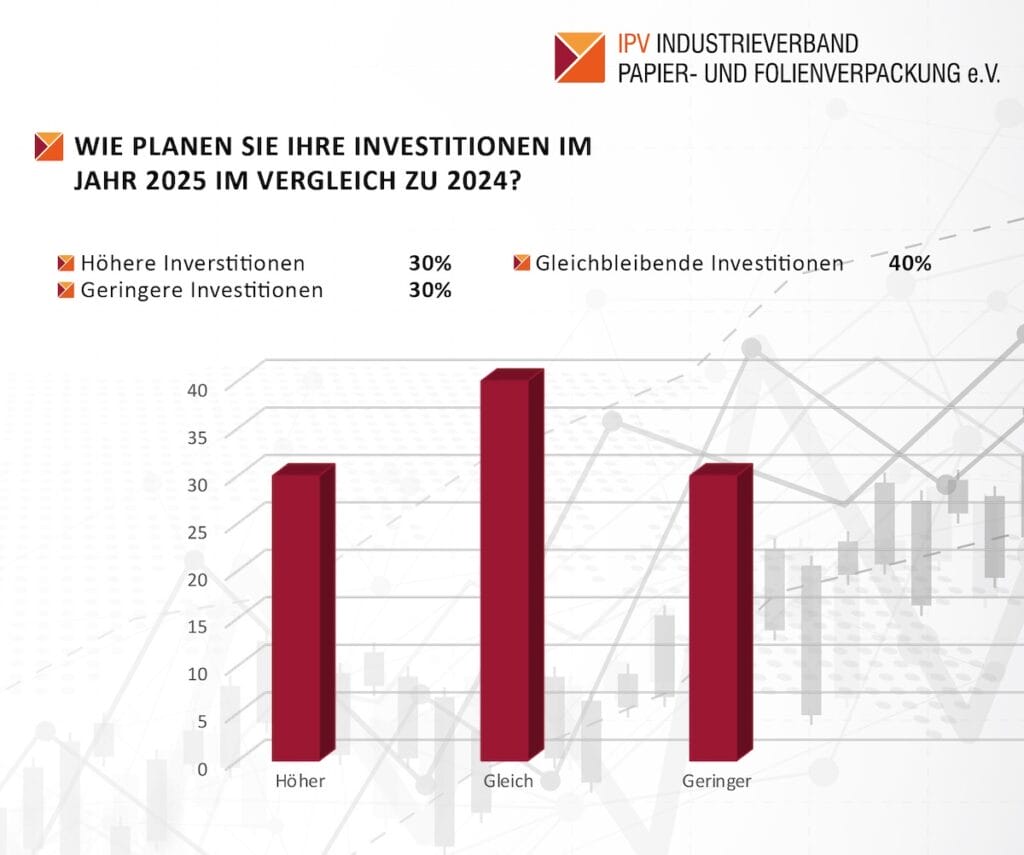

Despite the budget restraint, around half of the companies are planning targeted investments in their energy infrastructure - particularly in photovoltaics. However, only ten per cent of companies are increasing their total investment volume. The majority of measures are limited to increasing the efficiency of existing buildings. For 2025, 30 per cent of companies are even announcing a reduction in their investment budget. This means that the focus is increasingly shifting towards measures to ensure competitiveness.

78 per cent of those surveyed would like to see a stable, binding political framework in the long term rather than short-term funding programmes.

Regulatory hurdles slow down innovative strength

In addition to economic factors, the member companies also identify political framework conditions as a significant disadvantage for the location. In particular, the European Packaging Regulation (PPWR) and the Deforestation Regulation (EUDR) are considered to be bureaucratic, sometimes contradictory and not very practical in their current form. The IPV is calling for a fundamental revision of existing and planned regulations as well as more quality content in legislation.

Personnel policy characterised by restraint and a shortage of skilled workers

The personnel situation is another key problem. No company in the survey hired new employees in 2024. Every second company has not filled vacancies or has deliberately reduced staff. At the same time, 50 per cent of companies report a noticeable shortage of skilled workers - a significant increase compared to the previous year (11 per cent) and a return to the figures from 2022.

The training situation is particularly problematic: only 38 per cent of companies were able to fill all the training places on offer. Many positions remained unfilled, especially in production-related professions. The association is therefore calling for better labour market policy conditions, including more flexible working time models, a reduction in overtime regulations and the targeted promotion of qualified immigration.

Global context exacerbates uncertainty

Added to this is the uncertainty at international level. Around half of companies are concerned about the potential impact of political developments in the US - particularly with regard to protectionist measures such as punitive tariffs. A reliable European industrial and trade policy is therefore seen as essential. The association is also clearly opposed to distortions of competition within the EU and calls for fair market conditions for all member states.

Association sees potential - but calls for better political framework conditions

Despite the tense situation, the IPV emphasises the potential of flexible packaging solutions. Whether paper, plastic or composite - according to the association, the technologies offer sustainable and functional solutions for a wide range of applications. However, a clear industrial policy signal is needed for these to realise their strengths. The IPV is calling on politicians to reduce bureaucratic burdens, create a legally secure framework and guarantee investment security.