Mayr-Melnhof (MM) is starting the 2025 financial year with a significant increase in earnings compared to the same period last year, with the Food & Premium Packaging and Board & Paper divisions contributing to the positive development, according to the Vienna-based company.

Mayr-Melnhof Karton AG (MM) recorded a significant increase in earnings in the first quarter of 2025. Sales rose slightly by 1.7 % to EUR 1.043 billion, while adjusted EBITDA climbed by 26.2 % to EUR 119.3 million. The adjusted EBITDA margin also improved to 11.4 % (Q1/2024: 9.2 %). Despite continued weak demand and high pressure on margins, competitiveness remained stable.

Divisions at a glance

MM Food & Premium Packaging

- Sales: EUR 421.5 million (-1.7 %)

- Adjusted EBITDA margin: 11.0 % (+1.5 percentage points)

- Productivity increases and strict cost management ensured a robust result, despite continued pressure on margins and a difficult market situation.

- A major fire in Poland had a slight negative impact on the volume trend.

MM Pharma & Healthcare Packaging

- Sales: EUR 163.4 million (-0.9 %)

- Adjusted EBITDA margin: 5.4 % (-1.9 percentage points)

- Market demand was at the previous year's level, but the result was weaker. The focus remains on operational excellence and sustainable solutions.

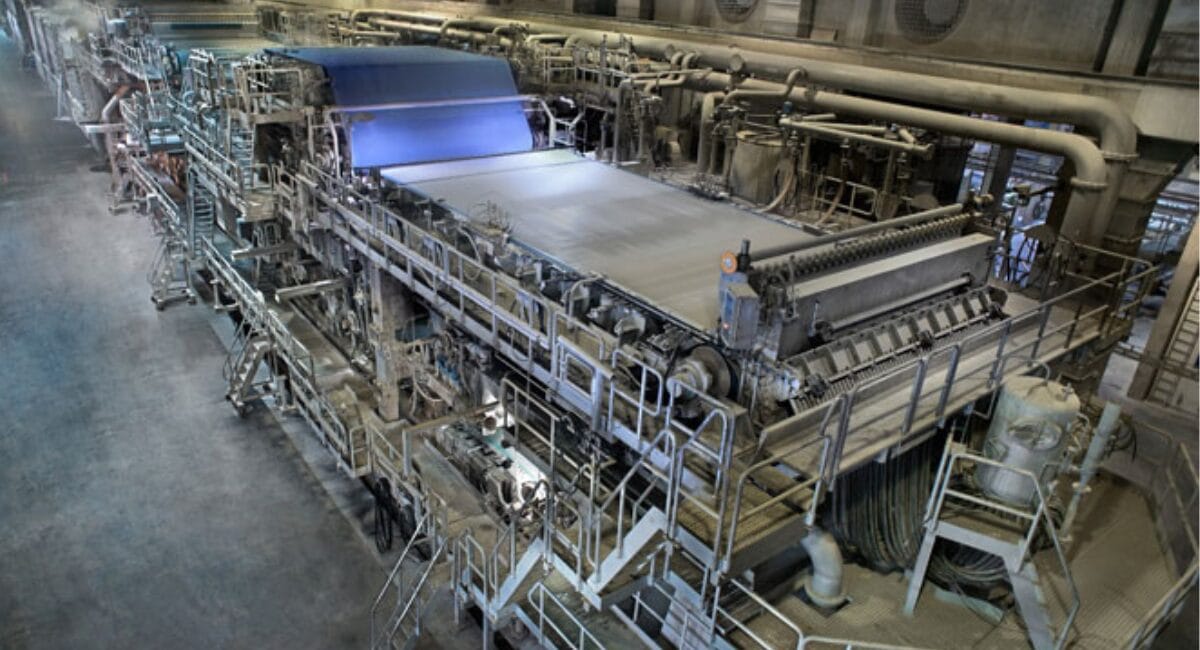

MM Board & Paper

- Sales: EUR 510.0 million (+5.5 %)

- Adjusted EBITDA margin: 1.1 % (previous year: -2.7 %)

- Earnings greatly improved thanks to higher capacity utilisation and sustainable cost savings.

- Production rose by 2.2 % to 813,000 tonnes.

Key financial figures at a glance (Q1/2025)

- Sales: EUR 1.042 billion (+1.7 %)

- Adjusted EBITDA: EUR 119.3 million (+26.2 %)

- Net profit for the period: EUR 21.1 million (+94.1 %)

- Earnings per share: EUR 1.04 (previous year: EUR 0.52)

- Cash flow from operating activities: EUR -128.2 million (previous year: EUR +52.5 million)

- Investments: EUR 55.7 million (previous year: EUR 92.8 million)

MM expects the market situation to remain subdued due to the weak economy and high level of uncertainty. Priority will be given to cost efficiency and innovation leadership in order to secure the earnings situation in the long term. The closing of the sale of the Tann Group (cigarette paper) is expected in the first half of 2025.

Source: Mayr-Melnhof