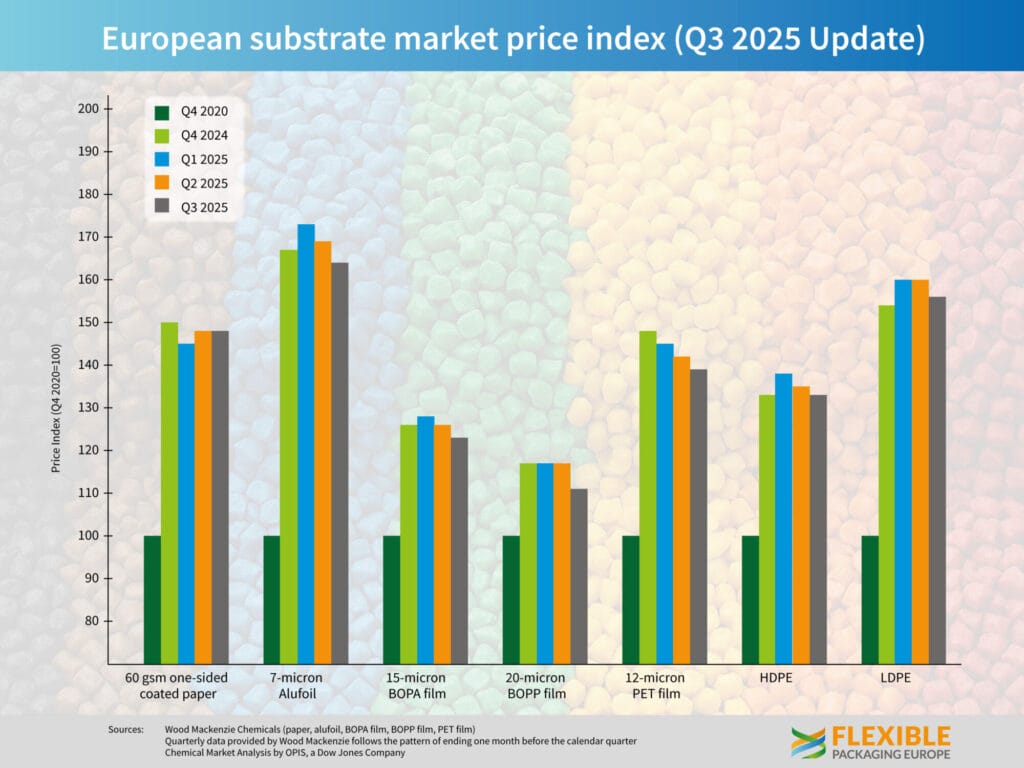

The markets for flexible packaging materials recorded slight price declines across all substrates in the third quarter of 2025. This was reported by the industry association Flexible Packaging Europe (FPE).

Prices for aluminium foil and BOPA, BOPP and BOPET films fell particularly sharply. While one-side coated paper (60 g/m²) remained stable, HDPE and LDPE continued the weakening trend observed in the first half of the year.

„Prices for BOPET film fell slightly by five cents per kilogramme in the third quarter. The price decline was mainly triggered by imports, while European producers kept their prices largely stable. BOPP film fell by eight cents per kilogramme due to lower raw material costs, and BOPA film fell by 10 cents in the same period - partly due to lower costs for PA6 granulate. Aluminium foil recorded a price drop of 17 cents, of which around ten cents were attributable to falling processing costs. Paper prices remained unchanged. Short-fibre pulp fell in price by 166 euros per tonne, mainly due to higher stock levels.“

Alexander Tkachenko from Wood Mackenzie

The Polyethylene market under pressure. Kaushik Mitra of Chemical Market Analytics by Opis, a Dow Jones company, said: „Markets have been less volatile this quarter, but sentiment has been weaker. July and August are traditionally the quietest months of the year, but The decline in demand was sharper than usual this time. The usual recovery in September has so far failed to materialise, as the sales markets are suffering from the macroeconomic slowdown and increased imports from China, which are dampening local demand.

The most important development this quarter relates to trade: the EU and the USA have finally signed the trade agreement. Particular attention is being paid to a possible EU regulation that would make US polyethylene exports to the EU duty-free could. Although the final list of affected product codes is not yet available, the broad scope of application leaves such scenarios open. Should the duty actually be cancelled, US PE resins could flood the European market and further weaken the already ailing competitiveness of European production“

In total The situation on the markets for flexible packaging remains challenging. Energy prices for electricity and gas remain high and volatile, Europe's industry is becoming increasingly dependent on imports and demand growth is weakening as many consumer goods categories are falling short of expectations.

„The commodity markets were characterised by widespread price declines in the third quarter. This provides processors with some short-term relief, but demand in important consumer markets remains weak. In addition, there are uncertainties in the geopolitical and trade policy environment - in particular the discussion about possible tariff exemptions for US polyethylene. We therefore expect market conditions to remain challenging in the second half of 2025, even though the industry is hoping for stabilisation and a slight upturn in private consumption, which could support demand for flexible packaging.“

Guido Aufdemkamp, Managing Director of Flexible Packaging Europe (FPE)

Source: Flexible Packaging Europe