The year 2021 is characterised by a rampant shortage of raw materials and its consequences. We take a look at the paper market and the associated industries and, together with industry representatives, ask ourselves when this crisis could be over and what we can learn from it for the future.

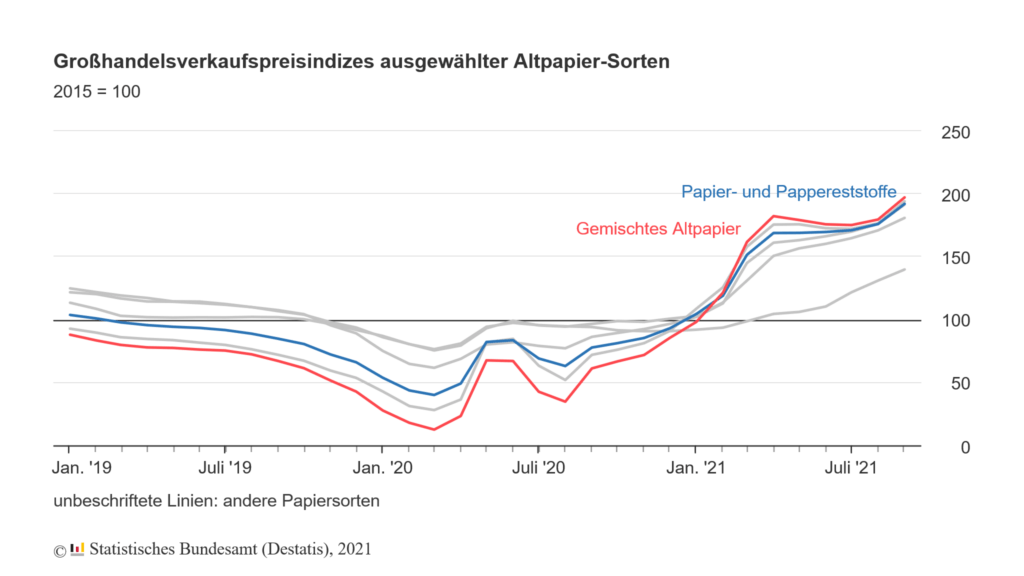

There could be disappointment under many a Christmas tree in Germany this year. By now, you will have heard about it everywhere, a growing shortage of raw materials in almost all industrial sectors and the resulting Supply bottlenecks. Since the beginning of the year, prices for a wide range of materials have skyrocketed, but in this country probably for no raw material as much as for paper. Wholesale prices for mixed waste paper more than tripled in September 2021 compared to the same month last year. How can this development be explained for a raw material that literally grows on trees?

The waste paper is missing

Of course, it's not that simple. Only 22 per cent of paper production in this country is covered by virgin wood. This is mainly used for so-called graphic paper, which is used to produce books, catalogues and the like. The lion's share of German paper production comes from mixed waste paper. In 2019, 78 per cent of the paper consumed in German households was returned to the paper industry as waste paper; the recycling rate of this return was a good 91 per cent in the same year. Waste paper utilisation has almost reached the cycle.

This is where the problems start. In the course of the first year of the pandemic, the production of printed matter fell noticeably. Advertising brochures, flyers, newspapers - all of this ended up less frequently in German households and therefore also less frequently in the recycling cycle. However, this trend has only become noticeable since the beginning of this year. As the market recovered, so did demand, which was felt to be increasing in all areas at the same time. In the packaging industry, this was particularly noticeable in the corrugated cardboard industry, as consumers - fuelled by the 2020 pandemic - are increasingly turning to online retail and thus shipping.

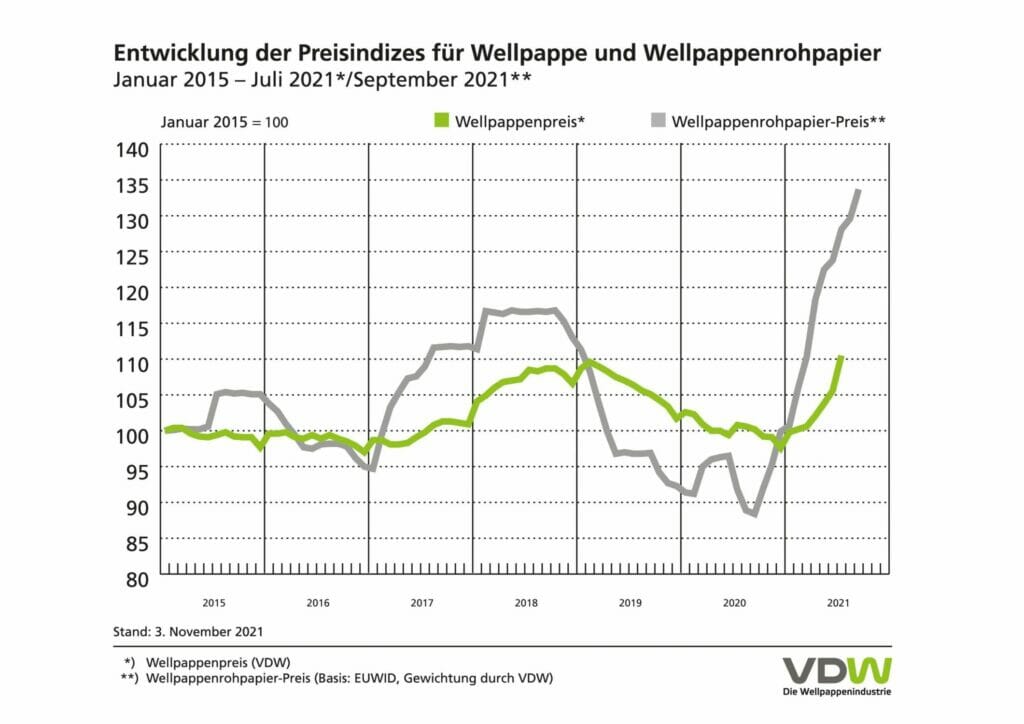

„Corrugated board is becoming increasingly popular as an environmentally friendly packaging material - which is actually a very positive development. Nevertheless, our industry is currently coming under increasing pressure, in particular due to the never-ending price increases for our most important raw material, paper„, says the chairman of the Association of the Corrugated Board Industry (VDW) Steffen P. Würth. In fact, on the one hand, the industry can hardly save itself from orders due to the steadily growing mail order business: in the first quarter of 2021, sales by the association's companies were already 7.6 per cent higher than in the first quarter of 2020.

Cost explosion on the commodities market

On the other hand, raw material costs have risen out of all proportion to this increase in sales due to the shortage: in September 2021, the industry paid 57.7 per cent more for waste paper-based corrugated base paper than in the same month of the previous year, while the price increase for corrugating medium made partly from fresh wood was as high as 71.4 per cent in the period from September 2020 to October 2021. This price has hardly been passed on to the customer so far, The average revenue per square metre of corrugated board „only“ increased by 10.3 per cent in the period from September 2020 to July 2021. „Measured against the explosion in paper costs and the rise in energy prices, we are therefore in a favourable position. in a drastic imbalance„, summarises Würth.

The upcoming Christmas season in particular poses a challenge for the industry. German households are ordering everything they can for the festive season to make sure there is plenty of joy under the tree. However, this also requires suitable shipping packaging, as they are often made from corrugated cardboard. Würth is cautiously optimistic in this respect: „The corrugated cardboard industry is producing at a consistently high capacity in order to meet the strong demand. Our industry is doing everything it can to supply its customers as quickly as possible and avoid bottlenecks in the Christmas business."

Lead times are significantly longer

Christmas business is already over for folding carton manufacturers. The point of contact here is confectionery packaging and, as we know, the sweet Christmas temptations are already available in the supermarkets from late autumn. However, there can be no talk of a relaxed situation. The confectionery business is continuing and the economy has also picked up strongly this year in the food service and cosmetics sectors, which are important for the folding carton industry. So the orders are there, but the material is scarce and expensive.

Customers are noticing this development above all in the longer lead times for orders. Last year, these were still at an average level of four to eight weeks, This period increased to ten to twenty weeks over the course of the summer. The shortage of used and virgin paper leads to according to a forecast by the British consultant NOA Prism for the European folding carton association ECMA This led to a noticeable discrepancy between order volumes (10.9 per cent) and actual volume growth (3.7 per cent). The supply chain could be seriously disrupted if this gap persists, according to a press release from the Trade Association of the Folding Carton Industry (In a flash survey conducted in November, FFI members were still complaining about the discrepancy between a good order situation and the fact that the supply of the corresponding raw materials cannot be planned for the long term - especially as their increased prices are putting additional pressure on the cost situation of folding carton manufacturers. The Association solid board cartons (VVK) is complaining about increasing cost pressure due to a shortage of raw materials.

When will the relaxation come?

The question is how long this situation will last. One of the main prerequisites for this is the normalisation of the waste paper cycle. In other words, the amount of waste paper returned from German households would have to return to pre-pandemic levels. If this is the case, the current accumulated demand would first have to be covered before the price of mixed waste paper in particular would return to its previous level. So much for the theory at least.

However, the market still seems to be a long way from this point at present, according to Thomas Braun, Managing Director at the Federal Association for Secondary Raw Materials and Waste Management (bvse): „The demand for waste paper is currently very high due to the economic situation and the massive increase in e-commerce worldwide. The paper and especially the cardboard industry is producing at full capacity, with full order books everywhere. Also due to new production capacities in the globally booming packaging paper sector The demand for recovered paper can only be met with great efforts on the part of the recovered paper industry. We even import waste paper to Germany to meet the demand for it. However, importing quantities from neighbouring European countries or the USA is difficult and expensive. A not inconsiderable proportion of the packaging produced in Germany on the basis of waste paper is also not returned to the collection containers in GermanyOn the one hand, the German economy exports the goods it produces in it, and on the other, it also sells the packaging itself as new paper to customers all over the world.“

Karsten Hunger, Managing Director of the Industrial Association for Paper and Film Packaging (IPV): „We expect the supply chains to normalise over the course of 2022 and the shortage of raw materials may ease in the middle of the year as demand markets calm down or normalise. However, this depends on an extremely large number of factors that we cannot influence, The global supply chain is subject to a variety of factors, such as the pandemic situation and vaccination progress, energy cost trends, global trade routes and the availability of containers. In recent months, we have already seen how even regionally limited problems (coronavirus outbreak in a port in China, cold snap in Texas) have quickly developed into global problems in the still fragile supply chains.“

Not just packaging

In addition to the already burdensome shortage of raw materials, paper processing packaging companies are also faced with the following challenges Two further side issues, that need to be taken into account. On the one hand, these are Printers and publishers. While under normal circumstances there is little conflict in the procurement of raw materials, things are different now. Publishers in particular are suffering from similarly massive problems as the corrugated cardboard industry, for example. In mid-October, the bosses of the traditional Munich publishing house C. H. Beck, Hans Dieter Beck and his nephew Jonathan Beck, an interview with the Handelsblatt on the occasion of the upcoming Frankfurt Book Fair. In it, Jonathan Beck expressed his concern, that there could be a shortage of books at Christmas due to the acute paper shortage. New editions could possibly only be printed in the new year after the current stocks have been sold off.

Another significant factor in the cost burden for the entire industry are the rising energy prices. In September, prices were on average 32.6 per cent higher than the same month last year. The price trend for natural gas stands out in particular, which rose by a whopping 58.9 per cent during this period - a situation that in view of the certification procedure suspended for the time being by the Federal Network Agency for the Nord Stream 2 gas pipeline.

Wait and see and save energy

However, Karsten Hunger (IPV) believes that many companies are already on the right track here: „Of course, it is not possible to be one hundred per cent sure of the changes. Nevertheless, companies are adapting to the foreseeable changes as best they can and continuously invest in measures for the future. Energy efficiency improvements, Photovoltaics, comprehensive conversion to LED lighting and Waste heat utilisation are just some of the activities that have already been implemented or are being planned.“

According to an ifo report from 24 November, the mood at the end of the year remains depressed. Supply bottlenecks for primary products and raw materials continue to grip the industry and a clear majority of companies are planning to increase prices.

So what is left but to hope that energy prices will miraculously recover and the waste paper cycle will return to normal? Andreas Helbig, spokesman for the FFI Executive Board, gives a clear recommendation for action: „In the current market situation, good, forward-looking planning is essential. Panic and safety purchases lead to additional shortages and are counterproductive. Customers are therefore well advised, planning with sufficient lead time, especially for new projects, to avoid new distortions."

Using energy more efficiently and reducing consumption, planning ahead (as far as possible), entering into more binding contracts - in addition to waiting for the waste paper market to normalise over the course of next year, these seem to be the measures that can be drawn as lessons from the current situation. They are certainly not miracle cures, but they point in the right direction, so that hopefully nobody will have to worry about missing presents under the Christmas tree next year.

Voices from the industry

The shortage of raw materials has not only the paper processing industry but the entire packaging industry in its grip. We have captured some voices from the associations.

Marcus Kirschner, Managing Director of the HPE Federal Association, on the situation

Marcus Kirschner, Managing Director of the Federal Association for Wooden Packaging, Pallets and Export Packaging, summarises the situation precisely and succinctly, and not just in the wood-processing packaging industry:

„The economic situation of the wood packaging industry is linked one-to-one with that of the manufacturing industry in Germany. This is due to the close interdependence with all industries in Germany. Almost 110.4 million pallets were produced in Germany in 2020. This immense demand is no surprise. A manufactured product almost always has to be transported. How well the German economy is doing can therefore be seen first and foremost from pallet production.

However, in addition to the economic consequences of the coronavirus restrictions, the pallet and wooden packaging industry is currently still experiencing struggling with high material prices and supply bottlenecks that have not yet been overcome in some areas. The companies are doing everything they can to continue to reliably supply their customers with pallets, costs and cable drums. The situation has now largely eased, although the past few months have been characterised by a precarious procurement situation, a period of shortages.

Characteristics of these shortage periods were Unclear delivery times, Unclear delivery quantities, Lack of clarity about the product ranges supplied and Uncertainties about the prices charged. Orders were more like wish lists: You didn't know what you would get when and under what conditions, and in the end you took what was delivered. Prices were dictated on delivery. Many products were not even available. This presented many companies with existential challenges.

Customers in the wooden packaging industry had to do without the 6-, 12-, 24- and 48-hour deliveries they were often used to. There were also quotas. Other suppliers were sought and the spiral was set in motion. It even accelerated, Both wood packaging manufacturers and customers had to ensure their ability to deliver and tried to secure volumes for the future as well. This has an immediate impact on liquidity as well as production and delivery capacity. In the meantime, this spiral has slowed down and is reversing somewhat, although a bottoming out is recognisable.

Nobody is currently able to estimate how the current and previously described situation will affect the second half of the year. However, it is likely that it will be somewhat weaker and that the previous year's figures will be achieved for the year as a whole, at least in the pallet segment. Moderate negative price trends do not even begin to reflect the speed at which prices peaked, and many companies also filled their warehouses and concluded long-term contracts (at maximum prices). The latter are causing companies a lot of trouble, as suppliers are insisting on contract fulfilment - even those who were previously completely indifferent to their own contractual obligations.

With this in mind, one could venture to predict that, if the global economy continues to pick up, taking into account the political influencing factors, climate change and the necessary transition to CO2-neutral economy current a bottom formation at a high level The current situation is likely to be characterised by a moderate continuation of the extremes observed last year in the coming year.“

Further news from the market

New packaging law passed

More ambitious circular economy policy required

Paperisation trend in the food industry on the rise

CVC 2026 focusses on early R strategies