The Covid-19 pandemic has disrupted global supply chains in many places and fuelled discussions about Reshoring, The trend is being fuelled by the "globalisation" trend, i.e. bringing production back home. Euler Hermes scrutinised companies in its latest study.

Between mid-October and early November 2020, the credit insurer surveyed a total of almost 1,200 companies from six different sectors, including mechanical engineering and food production, in Germany, the USA, the UK, France and Italy about supply chains in times of Covid-19 and any measures planned to stabilise them.

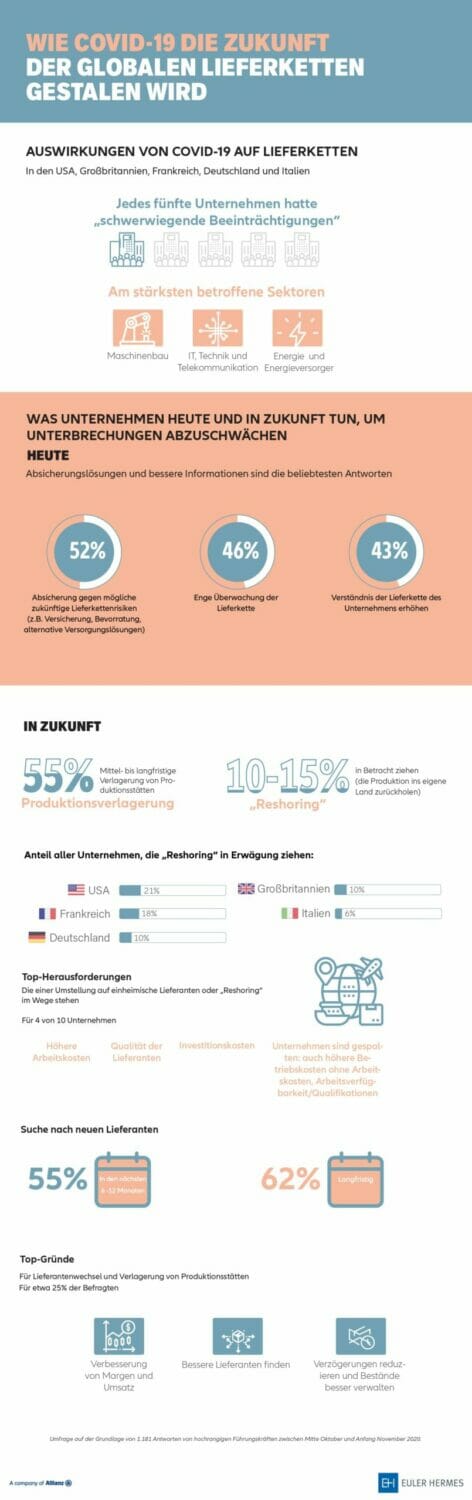

„Almost all of the companies surveyed (94%) had to deal with at least temporary disruptions to their own supply chain due to Covid-19, including in Germany (95%). One in five of these companies even reported serious disruptions. This shows just how interconnected today's global economy is and how big a shock Covid-19 has had on global supply chains. In response, more than half (52%) have already taken hedging measures. In addition, the majority of companies (55 per cent) are considering both relocating their production and finding new suppliers.“ Ron van het Hof, CEO of Euler Hermes in Germany, Austria and Switzerland

One in two company bosses say they have already reacted to the disruption to supply chains and taken protective measures. These range from insurance to Hamster purchases and stockpiling through to emergency suppliers as a backup. You have analysed the supply chains in detail and now monitor changes in much greater detail. However, production relocations and new suppliers are also playing a major role in companies' considerations for the future.

The lack of protective equipment at the beginning of the pandemic in particular had recently sparked discussions about bringing production back to the country. The The majority of the companies surveyed are considering such a so-called Reshoring but currently not.

Everyone is reviewing their supply chains

„It is not unusual for supply chains and their disruption to come into focus during a crisis,“ says Van het Hof. „Some companies will relocate their production back home or close to home. We However, we do not currently expect a rapid and far-reaching structural shift in trade as a result of strong relocalisation. With the exception of strategic sectors such as the medical and food sectors. Nevertheless, this discussion about supply chains and production locations is very important, as companies are looking closely at how they can position themselves to be as crisis-proof as possible.“

Bringing production back to neighbouring European countries

Of the 55 per cent of companies surveyed that are considering relocating their production, only between 10 per cent and 15 per cent are actually considering relocating production to a new location. home to relocate. In fact, however, more of the companies willing to relocate (30%), particularly in Germany (44%), are tending towards to the Nearshoring, i.e. the relocation of production to other EU countries - a compromise between geographical proximity and margin aspects.

„When it comes to relocalisation, companies need to look at both sides of the coin, especially the flip side. One Although shortening supply chains can create resilience, it is also associated with high logistics and labour costs, which could possibly only be passed on in part or are likely to drive up consumer prices. Due to increased automation, the reduction in production does not automatically go hand in hand with job creation. In addition, the shortening of supply chains reduces diversification and therefore increases the risk of concentration. In this respect, such a step makes sense in some cases, but we do not see such a trend on a large scale, as this would be associated with numerous risks and, in some cases, costs.“ George Dib, economist and international trade expert at the Euler Hermes Group

Costs and risks are also the main considerations behind supplier relationships. In addition to relocating production (55%), new supplier relationships are currently playing a major role for companies. Likewise, 55 per cent of the companies surveyed are considering looking for new suppliers in the next six to twelve months. The companies frequently state that they are doing so, that they would favour suppliers in their own country - but not exclusively.

„Unsurprisingly, the biggest patriots when considering new supplier relationships are American companies,“ says Dib. „The French would also favour suppliers in their own country. The proportion is somewhat lower among German companies. However, this is also due to the fact that they already have more suppliers in their home country than other countries."

Austrian suppliers are popular with Germans

76 per cent of the German companies surveyed already have suppliers in Germany. This is significantly higher than the average of 65 per cent for all companies surveyed. The In this respect, Germans also fear concentration risks much more than their counterparts in other countries. When looking for new suppliers, the German companies surveyed intend to look not only to their home country but also to their Austrian neighbours. Around a third of German companies' foreign suppliers are already based there. In addition to Germany and Austria, China and France also continue to play an important role.

When selecting suppliers, the German companies are also focussing on environmental aspects and innovativeness.a leading role.

Source: Euler Hermes