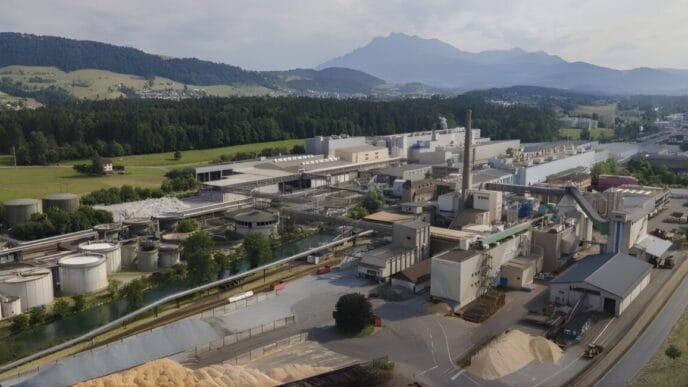

The film manufacturer Treofan has reached an investor solution after four months of self-administration. The management agreed on a takeover with a strategic buyer and the contracts have already been signed. This gives the Neunkirchen site a perspective beyond the insolvency proceedings.

The creditors have approved the transaction; the closing is still subject to approval by the antitrust authorities. Business operations will continue until the transfer. The investor plans to continue the production of capacitor and packaging films in Neunkirchen and to take over around 280 of the current 465 jobs.

Restructuring with job cuts and transfer company

Treofan has recorded a considerable decline in turnover in recent years, particularly in the packaging sector. Production capacity at the site is currently only half utilised. By the time the takeover is finalised in the first quarter of 2026, around 160 jobs will therefore be cut and around 25 fixed-term employment contracts will not be extended. To cushion the impact, a transfer company is to be set up to provide training and placement programmes for up to six months.

„With the takeover, the site in Neunkirchen once again has a future with a long-term, strategic investor.“

General representative Dr Anna Katharina Wilke from the restructuring law firm Flöther & Wissing

According to the self-administration, the staff reduction is a prerequisite for the future profitability of the site. Alternative acquisition concepts also provided for comparable or greater adjustments. The management now wants to negotiate a reconciliation of interests and a social plan with the works council.

Support in the investor process

The self-administration emphasises the constructive cooperation with the previous shareholder Jindal, who accompanied the process. Treofan was also supported by advisory teams from KPMG AG and the law firms Flöther & Wissing and Grub Brugger. According to the company, it was this interaction that made a solution possible within a short period of time.

Source: Treofan