The European packaging world is meeting again in Nuremberg for Fachpack. In the run-up to the event, we asked the industry associations how they currently assess the economic situation, what their member companies are worried about and whether there are any bright spots.

Anja Siegesmund, President of the BDE, Federal Association of the German Waste, Water and Recycling Industry

The packaging and recycling industry is under pressure: rising costs, an uncertain economy and a constant stream of new regulations are putting companies under pressure. With a recycling rate of around 67 per cent, Germany has a leading position in Europe and a strong innovation ecosystem: research, industrial applications and networks are optimally interlinked. However, this potential can only be realised with clear framework conditions, faster approvals and less bureaucracy. SMEs in particular need planning security. The geopolitical tensions show how vulnerable our supply of raw materials is. There are glimmers of hope: the demand for recyclates is rising and politicians are increasingly recognising the strategic role of the circular economy. Now is the time to shape the transition to a circular packaging economy together - Fachpack is a strong showcase for this.

Karsten Hunger, Managing Director of the Industrial Association for Paper and Film Packaging (IPV)

The situation remains challenging. There is no sign of an economic upturn so far and the reduction in bureaucracy is falling far short of expectations. Our member companies did not expect a boom. However, the stagnating economy and the lack of consumer confidence are preventing any mood of optimism.

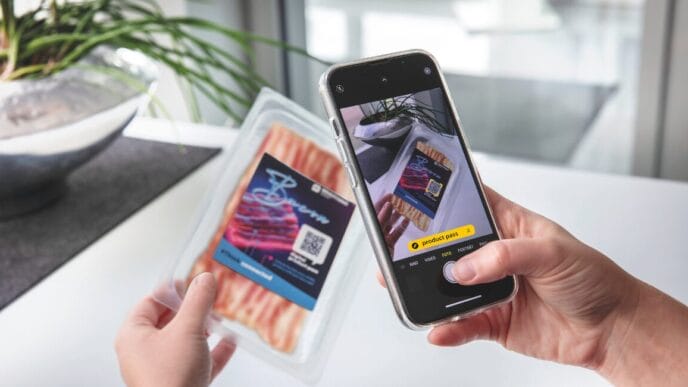

The industry has been suffering from falling sales for two years now. More than half of the companies expect a further deterioration in 2025. Political mistrust prevails: Decisions at EU and federal level often seem unrealistic, and a strong economic policy is still lacking. The unpredictable Trump policy with punitive tariffs and EU regulations are causing additional concerns. Nevertheless, a trade fair is always a place of hope. We see future opportunities in vending machine packaging, catering and light packaging.

Christiane Nelles, Managing Director of the Bundesverband Glasindustrie e. V. (BV Glas)

The container glass industry has struggled with declining sales over the past two years, and sentiment was correspondingly subdued - both in Germany and in Europe. In the first quarter of 2025, however, there was a significant increase in sales, which indicates a market recovery. The main concerns remain the continuing high energy costs, which are two to three times higher in Germany than in competitor countries, and the possible cancellation of the reduction in grid fees. The latter is currently linked by the Federal Network Agency to flexible electricity consumption, which is not compatible with the industry's continuous production processes.

The current challenges and concerns of the glass industry have now reached the political arena - we now hope that the right course will be set for the sustainable stabilisation and strengthening of Germany as a business location.

Mara Hancker, Managing Director of the Industrievereinigung Kunststoffverpackungen (IK)

The German plastic packaging industry is in a phase of cautious consolidation in 2025. The decline in turnover to EUR 25 billion (-3.1 %) in 2024 illustrates that the nominal increases in turnover in previous years were primarily due to inflation, while the real business volume is stagnating.

Despite structural challenges such as bureaucratic burdens and a shortage of skilled labour, the economic situation has improved slightly after a weak start to 2025. The IK economic surveys show: The proportion of companies with a pessimistic earnings forecast has fallen from 50 per cent to 39 per cent.

Trade policy risks - such as US tariffs - have a moderate impact on the plastic packaging industry; the European domestic market in particular remains central to growth. The industry is calling for political impetus for innovation, a reduction in bureaucracy and practical implementation of the PPWR.

Dr Oliver Wolfrum, Managing Director of the German Association of the Corrugated Board Industry (VDW)

The overall economic situation remains challenging; the hoped-for stabilisation of the recovery curve at the beginning of the year failed to materialise. This continues to affect important customers of the corrugated board industry. Nevertheless, our industry sees reasons for cautious optimism. We are hoping for additional positive effects from the German government's investment offensive.

The corrugated board industry has once again been concerned about costs this year; the weighted paper price level determined by the VDW has risen by around 13 per cent. On the political side, on the other hand, there have been promising signals in recent months with regard to the urgently needed reduction in bureaucracy - at both European and national level. However, it will be crucial that these announced reductions are now implemented swiftly and reach companies.